Introduction

QuickBooks is an accounting software that has become a popular choice for businesses of all sizes. It offers a range of features and solutions that help streamline the financial management process. Whether you are a small business owner or a professional accountant, understanding how to use QuickBooks effectively is essential.

This blog will provide an essential guide for beginners looking to get started with QuickBooks. From choosing the right version of QuickBooks for your business to setting up your account and understanding the interface, we will cover all the basics for QuickBooks users. We will also explore the various operations you can perform in QuickBooks, including creating and managing invoices, tracking expenses and sales, and utilizing reporting tools. Additionally, we will delve into the advanced features of QuickBooks, such as payroll management and using advanced reporting tools from Intuit.

By the end of this blog, you will have a comprehensive understanding of QuickBooks and be equipped with the knowledge to effectively use the software for your business needs.

Getting Started with QuickBooks

Before diving into the details of QuickBooks, it’s important to understand the basics of getting started with the software. This section will guide you through the process of choosing the right version of QuickBooks for your business and setting up your QuickBooks account.

Choosing the Right QuickBooks Version for Your Business

Choosing the right version of QuickBooks for your business can significantly impact your experience with the software. QuickBooks offers different products, including QuickBooks Online and QuickBooks Desktop Enterprise. QuickBooks Online is a cloud-based solution that allows you to access your account from anywhere, while QuickBooks Desktop Enterprise is a more robust version suitable for larger businesses.

When choosing the right version, consider factors such as pricing, features, and the specific needs of your business. QuickBooks offers different pricing plans based on the number of users and features included. It’s important to evaluate your business requirements and budget before making a decision. A QuickBooks Online account offers the flexibility and convenience of accessing your account from any device with an internet connection. On the other hand, QuickBooks Desktop Enterprise provides advanced features and enhanced security for larger businesses.

|

QuickBooks Products |

Pricing |

|

QuickBooks Online |

Flexible pricing plans based on features and number of users |

|

QuickBooks Desktop Enterprise |

Pricing based on subscription and number of users |

Setting Up Your QuickBooks Account

Once you have chosen the right version of QuickBooks books for your business, it’s time to set up your QuickBooks account. This involves creating a new account, entering your business information, and customizing the settings according to your preferences.

QuickBooks provides a user-friendly setup process that guides you through each step. You will be prompted to enter basic information about your business, such as your business name, industry, and contact details. You can also choose to work with a QuickBooks advisor who can assist you in setting up your account and provide guidance on using the software effectively.

During the setup process, you will have the option to customize your QuickBooks account based on your specific workflow and preferences. This includes setting up your chart of accounts, creating customer and vendor profiles, and configuring invoice and payment settings. Taking the time to set up your QuickBooks books account properly will ensure that the software works seamlessly for your business.

Understanding QuickBooks Interface

Once you have set up your QuickBooks account, it’s important to familiarize yourself with the QuickBooks interface. This section will walk you through the various elements of the interface and help you navigate the dashboard and menu options.

Navigating the Dashboard and Menu Options

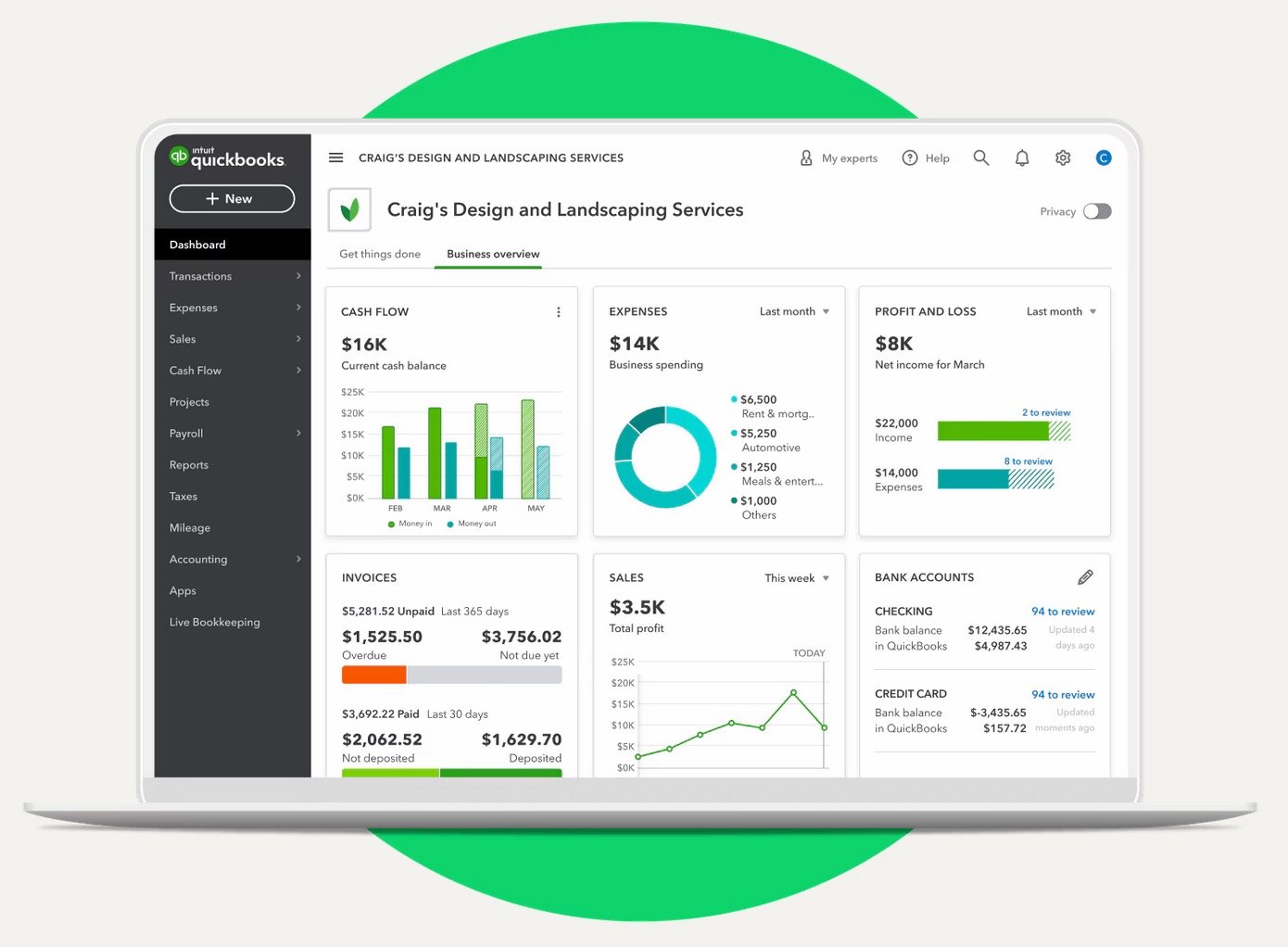

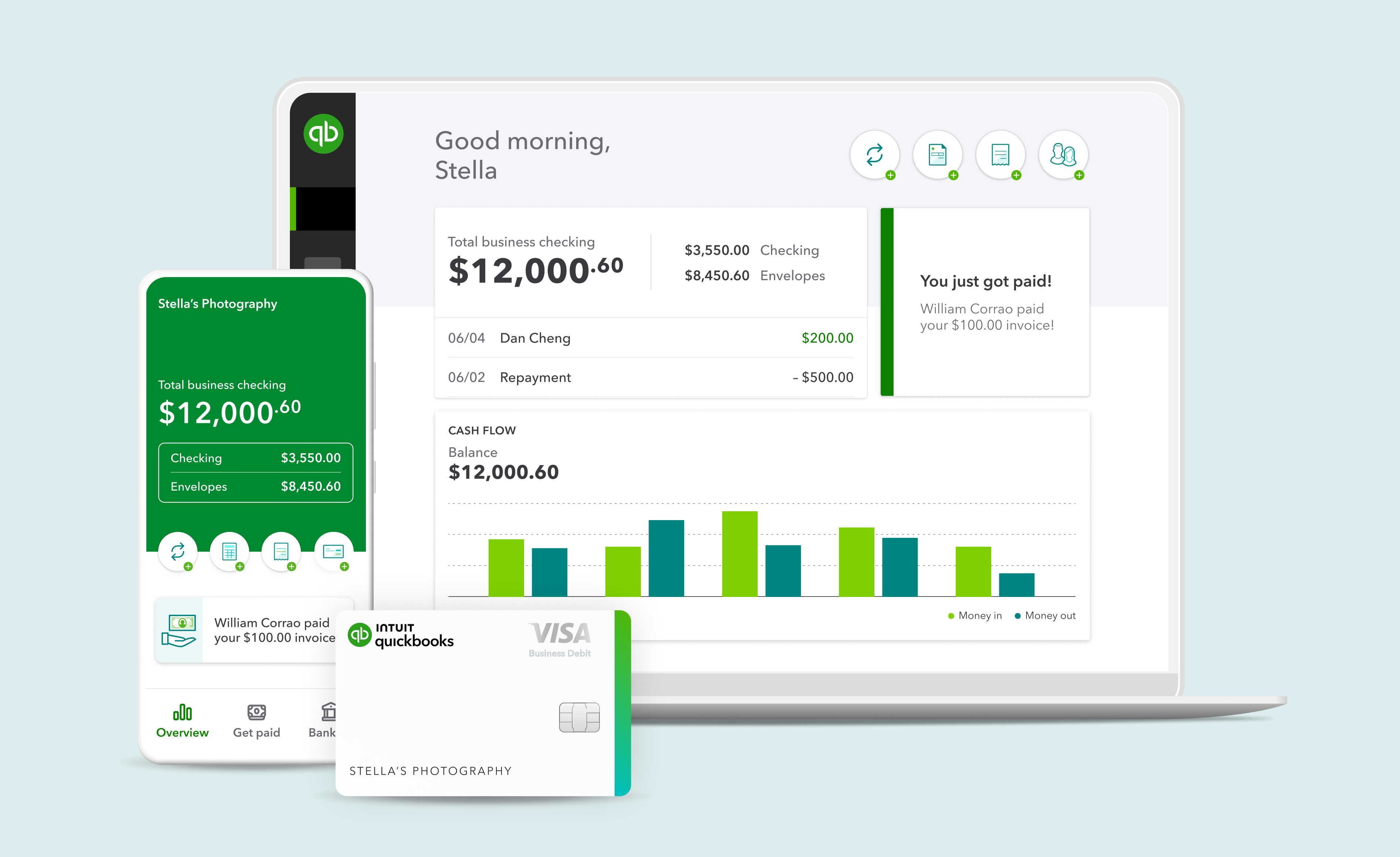

The QuickBooks dashboard is the central hub where you can access all the important features and functions of the software. It provides an overview of your business’s financial health and allows you to track your income, expenses, and cash flow.

The dashboard consists of various widgets and modules that can be customized to display the information most relevant to your business. You can add widgets for tasks such as creating invoices, tracking expenses, and viewing financial reports.

The menu options in QuickBooks allow you to navigate through different areas of the software and perform various tasks. From the menu, you can access features such as invoicing, expense tracking, and reporting. Familiarizing yourself with the menu options will help you navigate through QuickBooks books efficiently and streamline your workflow.

Customizing Your QuickBooks Experience and Workflow

QuickBooks offers several customization options that allow you to tailor the software to your specific needs. This section will explore the various customization features available in QuickBooks and how you can personalize your QuickBooks experience.

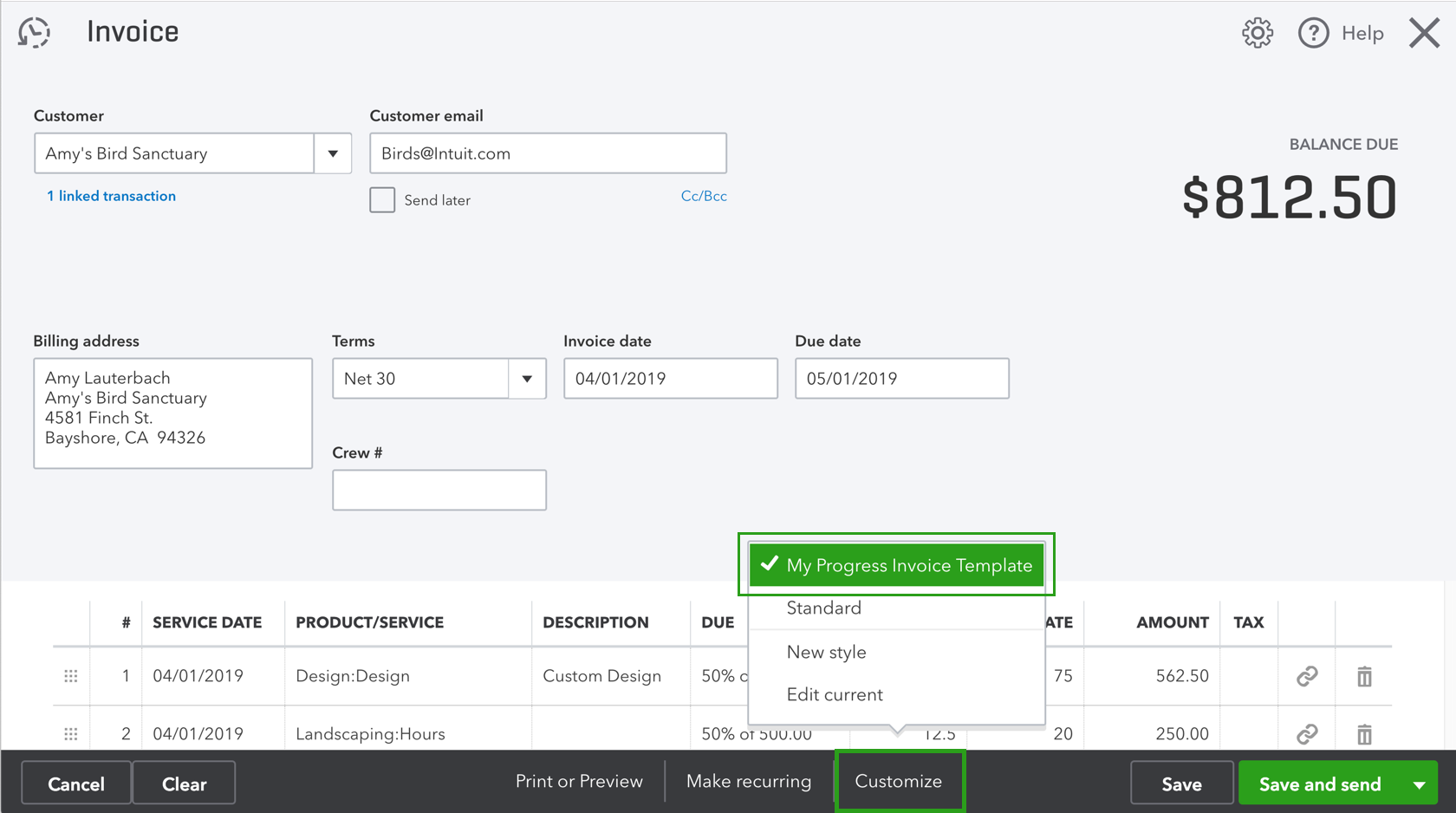

One of the key customization options in QuickBooks is the ability to customize forms and templates. You can create customized invoices, purchase orders, and other forms that reflect your brand identity. QuickBooks also allows you to add your company logo, customize fonts and colors, and include personalized messages on your forms.

In addition to forms customization, QuickBooks provides options for customizing reports and dashboards. You can choose the specific data and metrics you want to include in your reports and customize the layout and formatting to suit your preferences. Customizing your QuickBooks books experience will help you work more efficiently and make the software feel like a personalized solution for your business.

Basic QuickBooks Operations

Now that you are familiar with the QuickBooks interface, it’s time to dive into the basic operations you can perform in QuickBooks. This section will cover essential tasks such as creating and managing invoices, tracking expenses and sales, and utilizing reporting tools.

Creating and Managing Invoices

Creating and managing invoices is a fundamental task in QuickBooks. It allows you to bill your customers for products or services rendered. Here are some key steps for creating and managing invoices in QuickBooks:

- Enter customer information: Enter the customer’s name, address, and contact information in the customer profile section of QuickBooks.

- Create an invoice: Select the customer and enter the products or services provided. Include the quantity, price, and any applicable discounts or taxes.

- Send the invoice: Once the invoice is complete, you can send it to the customer via email or print a hard copy.

- Track payments: QuickBooks allows you to track payments received against each invoice. You can mark invoices as paid and record the payment method.

By effectively managing your invoices in QuickBooks, you can ensure timely payments and maintain accurate records of your transactions.

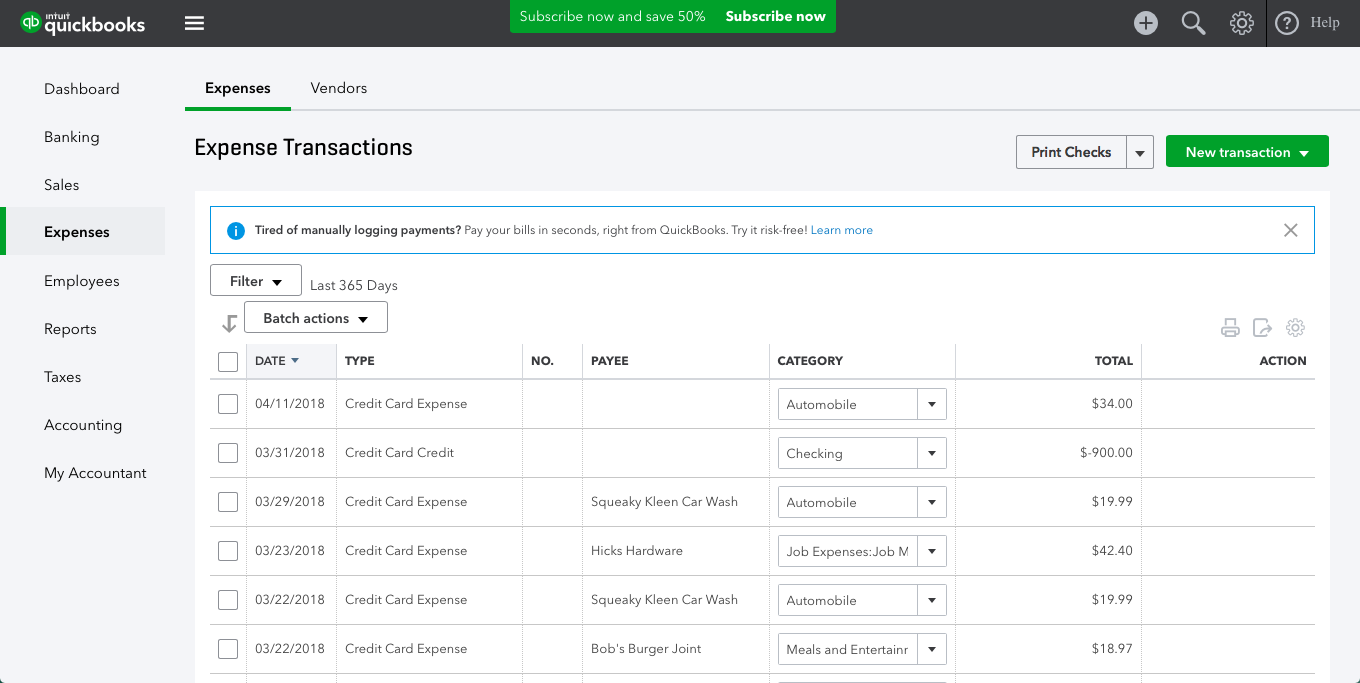

Tracking Expenses and Sales

Tracking expenses and sales is crucial for monitoring the financial health of your business. QuickBooks books provides tools to help you track and categorize your expenses and sales. Here are some key steps for tracking expenses and sales in QuickBooks:

- Add expenses: Enter your business expenses in QuickBooks, including receipts and invoices. Categorize expenses by type, such as office supplies, utilities, or travel.

- Track income: Record your sales and income in QuickBooks. This can include sales from products or services, as well as any other sources of income.

- Reconcile banking transactions: Connect your bank accounts to QuickBooks to automatically import and categorize your banking transactions. This helps keep your financial records up to date and accurate.

- Generate financial reports: QuickBooks offers a range of reporting tools that allow you to generate reports on your expenses, sales, and overall financial performance.

Tracking expenses and sales in QuickBooks enables you to make informed decisions about your business and ensure that your finances are in order.

Advanced QuickBooks Features

In addition to the basic operations, QuickBooks offers several advanced features that can enhance your financial management process. This section will explore two advanced features: utilizing QuickBooks for payroll management and understanding and using reporting tools.

Utilizing QuickBooks for Payroll Management

Managing payroll can be a complex task, but QuickBooks simplifies the process with its payroll management features. QuickBooks Desktop offers payroll functionality as part of its subscription. Here are some key benefits of utilizing QuickBooks books for payroll management:

- Automated payroll calculations: QuickBooks automatically calculates payroll taxes, deductions, and contributions, saving you time and reducing the risk of errors.

- Direct deposit: QuickBooks allows you to set up direct deposit for your employees, ensuring timely and secure payment.

- Payroll tax filing: QuickBooks can generate payroll tax forms and help you file them electronically, streamlining the tax filing process.

- Employee self-service: QuickBooks provides employee self-service options, allowing employees to access their pay stubs and tax forms online.

By utilizing QuickBooks books for payroll management, you can streamline your payroll processes and ensure compliance with tax regulations.

Understanding and Using Reporting Tools

QuickBooks offers a range of reporting tools that allow you to gain valuable insights into your business’s financial performance. Understanding and using these reporting tools can help you make informed decisions and identify areas for improvement. Here are some key reporting tools in QuickBooks:

- Profit and Loss Statement: This report provides an overview of your business’s income, expenses, and net profit or loss.

- Balance Sheet: The balance sheet report shows your business’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: This report tracks the movement of cash into and out of your business, helping you understand your cash flow.

- Custom Reports: QuickBooks allows you to create custom reports based on specific criteria or metrics that are important to your business.

By utilizing QuickBooks’ reporting tools, you can gain a deeper understanding of your business’s financial performance and make data-driven decisions.

UpLevel CFO is a certified ProAdvisor for Quickbooks…Schedule a Free Consultation with one of our Accounting Specialists today!

QuickBooks Tips and Tricks

In addition to the essential operations and advanced features, there are several tips and tricks that can help you maximize your use of QuickBooks. This section will provide some useful tips and tricks to enhance your QuickBooks experience.

Automating Tasks in QuickBooks

Automation is a key feature of QuickBooks that can greatly enhance a company’s workflow. By automating repetitive tasks, businesses can save time and reduce the potential for human errors. QuickBooks offers several automation features, such as automatic invoicing, recurring transactions, and bank feeds.

With automatic invoicing, businesses can set up templates for their invoices and have them sent out automatically at specific intervals. This eliminates the need to manually create and send invoices, saving time and ensuring that invoices are sent out in a timely manner.

Recurring transactions allow businesses to set up automatic payments for recurring expenses or income. This can be especially useful for monthly bills or regular customer payments. By automating these transactions, businesses can ensure that payments are made on time and reduce the risk of missed payments.

Bank feeds in QuickBooks books automatically import transactions from a company’s bank accounts, making it easier to reconcile accounts and keep track of expenses. This saves time compared to manually entering each transaction and reduces the potential for errors.

By leveraging the automation features in QuickBooks, businesses can streamline their workflow and focus on more important tasks, ultimately improving productivity and efficiency.

Integrating QuickBooks books with Other Software

Integrating QuickBooks with other software is a smart move for businesses looking to streamline their operations and improve efficiency. QuickBooks offers integration capabilities with a wide range of software, including CRM systems, e-commerce platforms, and payroll software.

By integrating QuickBooks with a CRM system, businesses can ensure that customer data is synced between the two systems. This allows for a seamless flow of information, making it easier to track customer interactions, send invoices, and manage sales.

Integrating QuickBooks with an e-commerce platform allows businesses to automatically import sales data and inventory information into QuickBooks. This eliminates the need for manual data entry and ensures that inventory levels are accurate and up to date.

Payroll integration with QuickBooks books simplifies the payroll process by automatically syncing employee data, hours worked, and tax information. This saves time and reduces the potential for payroll errors.

Overall, integrating QuickBooks books with other software can improve data accuracy, reduce manual data entry, and streamline operations, allowing businesses to focus on growth and profitability.

UpLevel CFO is a certified Pro Advisor for Quickbooks…Schedule a Free Consultation with one of our Accounting Specialists today!

Moving Beyond Basics

Once you have mastered the basics of QuickBooks, you can explore advanced features and functionality to further optimize your accounting processes. Here are a few areas to consider:

- Exploring QuickBooks add-ons and extensions: There are numerous add-ons and extensions available that can enhance the capabilities of QuickBooks for specific business needs.

- Advanced reporting and analytics in QuickBooks: Dive deeper into QuickBooks’ reporting and analytics capabilities to gain valuable insights into your business’s financial performance.

By going beyond the basics, you can unlock the full potential of QuickBooks books and tailor it to meet the specific needs of your business.

Exploring QuickBooks Add-Ons and Extensions

QuickBooks offers a range of add-ons and extensions that can enhance its functionality and provide additional features tailored to specific business needs. Here are a few popular QuickBooks add-ons and extensions:

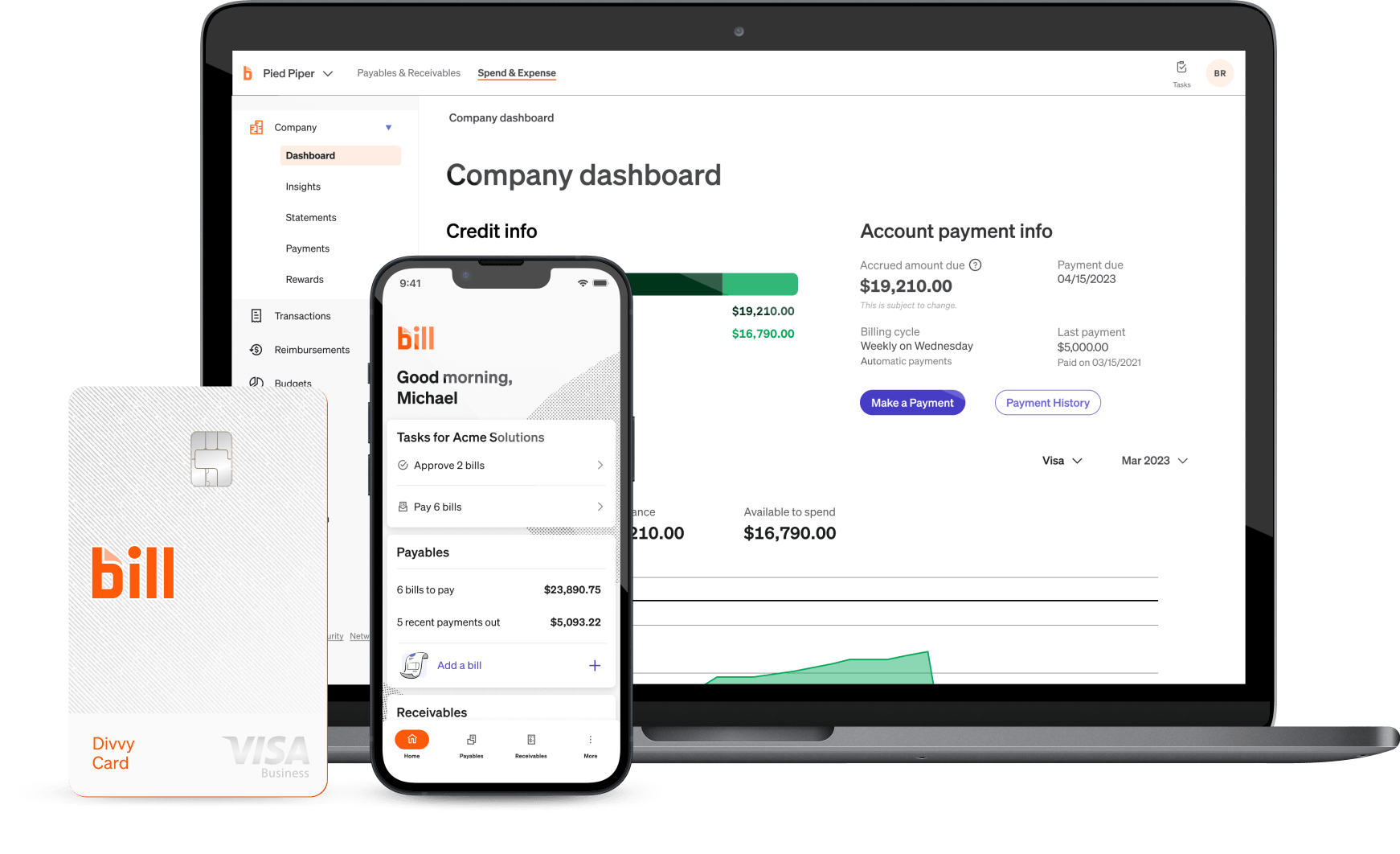

- Bill.com: Simplify your accounts payable process with electronic payments, automated workflows, and document management.

- Expensify: Streamline expense reporting by automating receipt tracking, expense categorization, and reimbursement processes.

- Tallie: Easily capture and categorize expenses on the go with this mobile expense management app.

- Avalara: Automate sales tax calculations and compliance to ensure accurate and timely reporting.

- Dext: Capture, organize, and extract data from receipts, bills, and invoices for seamless bookkeeping.

- Qvinci: Consolidate financial data from multiple QuickBooks files for comprehensive reporting and analysis.

- Fathom: Analyze and visualize financial data with interactive dashboards and reports.

By exploring these add-ons and extensions, businesses can customize QuickBooks to meet their unique needs and optimize their accounting processes.

Advanced Reporting and Analytics in QuickBooks

QuickBooks offers advanced reporting and analytics features that can provide valuable insights into a business’s financial performance. Here are some key features to explore:

- Customizable reports: Create customized reports tailored to specific business needs, such as profitability analysis, cash flow forecasting, and budget vs. actuals.

- Dashboards: Visualize key performance indicators (KPIs) and financial metrics through interactive dashboards for real-time monitoring and decision-making.

- Advanced filters and sorting: Refine data analysis by applying advanced filters and sorting options to focus on specific criteria or trends.

- Comparative analysis: Compare financial data across different periods or segments to identify trends, patterns, and areas for improvement.

By leveraging these advanced reporting and analytics features in QuickBooks, businesses can gain deeper insights into their financial data and make informed decisions to drive growth and profitability.

Conclusion

In the realm of QuickBooks, mastering the basics is just the start. From customizing your experience to delving into advanced features and troubleshooting issues, there’s a wealth of knowledge waiting to be explored. By understanding common mistakes and embracing tips and tricks, you can enhance your QuickBooks books proficiency. Keep evolving by exploring add-ons, industry-specific adaptations, and advanced reporting. Remember, continuous learning is key to maximizing the potential of QuickBooks for your business’s financial management. Dive into the world of QuickBooks with confidence and curiosity, and watch your efficiency soar.

UpLevel CFO is a certified ProAdvisor for Quickbooks…Schedule a Free Consultation with one of our Accounting Specialists today!

Frequently Asked Questions

Are there any common mistakes that beginners should be cautious of when using QuickBooks?

Avoid common mistakes like not reconciling accounts regularly, neglecting to back up data, and improper categorization. Stay alert to avoid issues with financial reports and tax filings. Learning from these errors can enhance your QuickBooks experience.

Can I Migrate My Existing Financial Data to QuickBooks?

Yes, you can migrate your existing financial data to QuickBooks. The process of migrating data involves transferring your financial information from your previous accounting software or spreadsheets to QuickBooks. This can be done by exporting your data in a compatible format and then importing it into QuickBooks. QuickBooks provides step-by-step instructions on how to migrate your data during the setup process, making it a seamless transition for new users. With QuickBooks Online (QBO), you can also connect your bank accounts and credit cards to automatically import your financial transactions, saving you time and effort in manual data entry.

How can QuickBooks help beginners manage their finances effectively?

By providing user-friendly interfaces and essential tools, QuickBooks simplifies financial management tasks for beginners. From setting up accounts to generating detailed reports, QuickBooks streamlines processes, ensuring efficient tracking of expenses and sales. Utilize its features for effective financial organization and management.

Can QuickBooks be customized to suit the specific needs of different types of businesses?

QuickBooks can indeed be customized to cater to the specific requirements of various businesses. From setting up unique accounts to tailoring reports and features, QuickBooks offers flexibility for different industries. Learn how to personalize your QuickBooks experience for optimal business management.

Recent Comments